The US and UK markets were closed on Monday, but European government bond yields sharply fell, which is a direct consequence of rumors that the Biden administration and the Republican majority in Congress are close to reaching an agreement.

The removal of the threat of a US default contributes to an increase in risk appetite and, at the same time, a slight decrease in demand for the US dollar as demand for bonds decreases. The dollar is also facing pressure due to the upcoming meetings of the Bank of England and the European Central Bank, where further rate hikes are anticipated, and uncertainty regarding the possible actions of the Bank of Japan at the June 16 meeting.

NZD/USD

The kiwi is facing increasing pressure as the reasons that could prompt the Reserve Bank of New Zealand to raise rates above the current 5.50% are diminishing, with the main one being the threat of an almost inevitable recession.

Retail sales remained unchanged in April (forecast was +0.2%), a decline of 1.4% in the first quarter, and a decline of 1% in the last quarter of the previous year. This means that consumer activity is declining despite high migration rates. Trade indicators have also deteriorated significantly, with a 3.4% decrease in terms of trade for goods in the first quarter and an expected decline in exports.

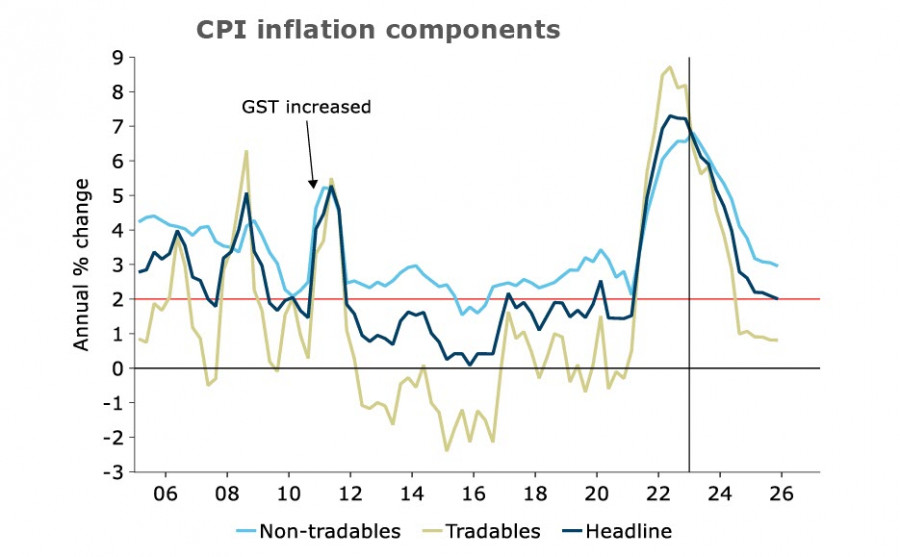

While expectations for an increase in the Federal Reserve rate are growing and markets are anticipating another hike in either June or July, the RBNZ announced a pause that is expected to last at least until November. In addition, there is the threat of an economic slowdown amid still uncertain prospects for inflation. Although inflation is expected to slow down in the second half of the year, it is just a forecast, while the threat of a recession is very real, as is the pause taken by the RBNZ.

Overall, based on the data, the demand for NZD is expected to decrease due to worsening trade indicators, pressure on the current account, and an increase in the yield spread in favor of the US dollar.

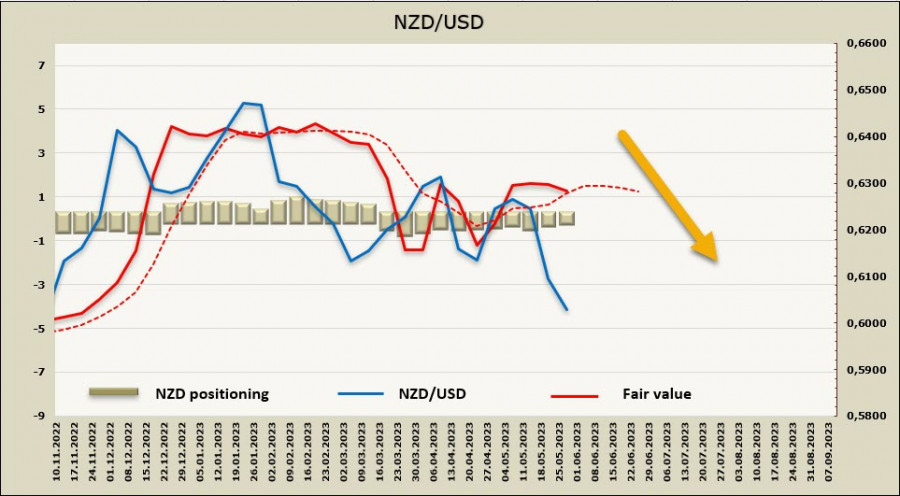

Positioning on NZD continues to balance at near-zero levels, with slight deviations in either direction. Over the reporting week, the net short position decreased by 107 million to -23 million, reaching a negligible level. The calculated price has shifted downwards.

Last week, we predicted that after the RBNZ decision, the kiwi would fall towards the support level at 0.6020. This scenario has played out, and we can assume that it will continue to fall. A probable correction will find resistance near 0.6079, where selling may resume. We expect another test of support at 0.6020 and further movement towards the target of 0.5940/50, and then 0.5900.

AUD/USD

Reserve Bank of Australia Governor Philip Lowe, as reported in the Australian media, held a "pessimistic" briefing behind closed doors with the House Economics Committee. Sources described the tone as "noticeably more pessimistic due to the emphasis on risks to achieving the bank's forecast targets for inflation and unemployment."

Markets are currently assessing the probability of another rate hike by the RBA and the likelihood of the Bank taking a pause approximately equally. The key value will be the tone of Lowe's testimony before the Senate Economics Committee. The NAB Bank estimates the peak rate to reach 4.1%, which will be achieved in August or July.

On Friday, June 2, an important decision will be made regarding the minimum wage. Changes will be announced for two indicators - the minimum wage, which will affect around 200,000 workers, and the volume of bonus payments, which will be significant for 2.4 million workers. Preliminarily, according to the Treasury, a 7% increase is expected for the first indicator and a 4% increase for the second, which will likely be seen by the markets as a factor fueling inflation.

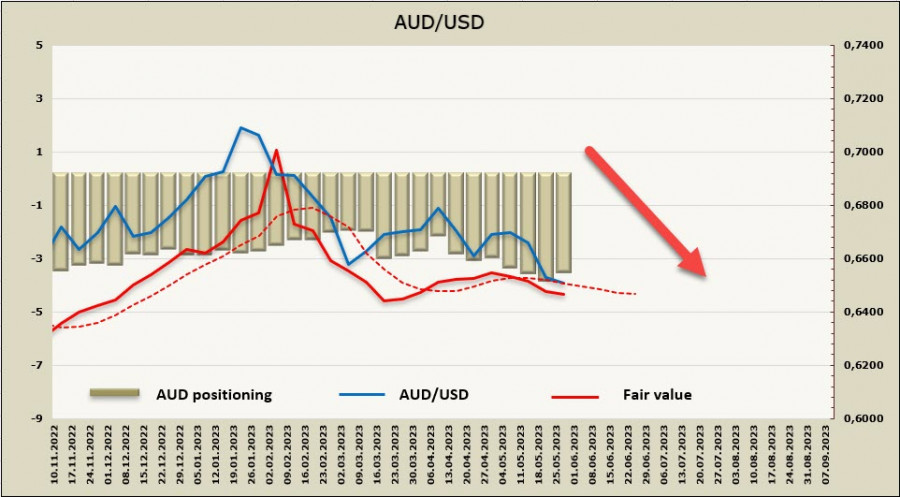

The net short position on AUD decreased by 323 million over the reporting week to -3.244 billion. The positioning remains persistently bearish, with the calculated price below the long-term average and directed downwards.

The bearish impulse we anticipated in the previous review has developed, although the price did not reach the target of 0.6466. Nevertheless, there are no grounds to expect a revival of growth, and any potential upward retracement is likely to stop in the 0.6560/80 zone, after which selling will resume. The nearest target is 0.6466, followed by technically significant levels down to the local low of 0.6172.